湿法消解—火焰原子吸收法

测定硅酸盐岩石样品中的铜

实验报告

院系:地球科学系

班级与学号:地质班

报告人:

任课指导老师:彭卓伦

日期:20##年11月24日

实验目的:

1. 掌握湿法消解地质样品的一般方法;

2. 掌握标准溶液的配制;

3. 了解和掌握原子吸收分析原理,仪器结构与操作及数据的分析讨论。

化学试剂:

蒸馏水、浓硝酸、氢氟酸、浓盐酸、硅酸盐岩石样品、99.999%的高纯度氧化铜

使用仪器:

塑料坩埚、电子天平、牛角勺、电热板、100ml容量瓶、玻璃量筒、塑料量筒、胶头滴管、针筒、移液管、烧杯、玻璃棒、手套、洗瓶、称量纸、标签纸、AA7000SP原子吸收光谱仪

实验步骤:

1. 样品预处理阶段(湿法消解)

(1)研磨:岩石样品破碎并用玛瑙钵研磨成粉末(200目)。

(2)称样:在电子分析天平上放置一张滤纸,用电子分析天平称取样品0.1994g,然后转移至已经清洗过的坩埚中,编号YZD01-3;再称取样品0.2017g,然后转移至坩埚中,编号YZD01-4。

(3) 溶样(在通风橱中进行):本次实验选择的溶样酸体系是3ml HNO3+6ml HF+9ml Hcl。戴上双层塑料手套,依次用不同的针筒量取3ml浓硝酸、9ml浓盐酸和6ml氢氟酸分别加入坩埚YZD01-3和坩埚YZD01-4中,将坩埚放在电热板上进行加热,并记下坩埚编号,不时摇动坩埚以加速样品的分解。

在电热板上加热时首先升温至70℃,保持3h;再升温至110℃,保持3h;然后升温至150℃,蒸干样品并保持2h。如果坩埚中的溶液还未清澈,可适当再加入少许HF酸溶解样品,待溶液清澈后,将溶液蒸至近干,呈湿盐状。取下坩埚,加入十滴浓硝酸(可将样品中的有机物氧化掉),将坩埚放回到电热板上,直至蒸干(赶走氢氟酸),再重复一次。取下坩埚,用针筒量取5ml的1:1的硝酸加入坩埚中,用玻璃棒搅拌坩埚中溶液,若仍有固体残渣可放至电热板上加热以加速溶解残渣。然后,将坩埚中的溶液倒入定容用的100ml的容量瓶中,并用蒸馏水清洗坩埚内壁多次,洗液用玻璃棒引入容量瓶中。

(4)定容:容量瓶中的溶液冷却至室温后,开始定容,然后贴上标签。

(5)清洗:将用过的所有用品清洗干净,并把试剂放回到贮柜中。

2. 配置标准溶液

(1)称样:用电子天平称取0.1250克高纯度CuO(99.999%),放至烧杯中;

(2)配置一级母液:用量筒量取体积比为1:1的硝酸20ml,将配制好的硝酸缓慢倒入装有CuO的烧杯中,用玻璃棒搅拌,加速溶解。待CuO全部溶解后,将其全部移至100ml容量瓶中,用蒸馏水进行定容。此溶液每毫升含1mg的Cu;

(3)配置二级母液:从标准溶液中,分别用移液管取0ml、0.05ml、0.1ml、0.15ml、0.2ml溶液分别置于100ml的容量瓶中,用蒸馏水分别进行定容。本次实验所用的瓶子非容量瓶,故借用电子分析天平辅助定容。

(4)这5个100ml的容量瓶中的溶液便组成了Cu的标准系列溶液,其Cu的浓度分别为0mg/l、0. 5mg/l、1mg/l、1.5mg/l、2mg/l。分别写好标签,贴在容量瓶上。

3. 上AAS机测试

AAS仪器型号是AA7000SP,本次实验的助燃气为空气,燃气为乙炔。

(1)调试仪器:安装并调节好空气压缩机和燃料供应设备,其中乙炔燃气应通过浓硫酸净化(空气:乙炔=6:1)。然后安装测试元素相应的空心阴极灯(Cu灯),并记住灯所在的编号及灯上该元素的灵敏线及额定电流。取下原子化器,用刀片将原子化器的狭缝清理干净,打开总开关,接通电源;

(2)打开计算机,进入工作站;

(3)点击控制——仪器初始化,成功后点击终止;

(4)点击分析设置/设置仪器参数:选择灯号和元素Cu,设置波长324.7nm等,然后扫描相应的波长,调整空心阴极灯位置,点击能量平衡,再点击确定;

(5)点击文件,新建项目,设置好所配标准溶液浓度和测量次数以及未知样品的测定次数等,完成;

(6)对燃烧头光路,先高度相切,再使燃烧头中间和两边能量处于40%-60%之间;

(7)检查水封,必须有足够的水;

(8)先打开空压机,(先打开风机开关,后打开工作开关),调压至0.26-0.3MPa。然后打开乙炔总阀,调分压为0.06-0.08MPa;

(9)按红色点火开关点火(绿色为灭火开关),调节燃气流量至中性火焰;

(10)测试样品前,先把毛细管旋入蒸馏水中1-2min吸取清洗仪器,然后点击计算机上的平衡,使能量处于100%的状态;

(11)然后将毛细管旋入Cu浓度为0mg/l的标准溶液,点击计算机上的开始,待曲线逐渐稳定后,点击采样,采样完成之后,点击暂停;将毛细管旋入蒸馏水中1-2min吸取清洗仪器,接下来按照相同的实验步骤测试剩余的四种标准溶液(测试过程中要把燃烧器的门关上,避免风影响测试结果);

(12)测试结束后点击结束——报告——打印报告;

(13)关机:

1)进样管放蒸馏水中冲洗5min,再干烧1min;

2)关掉乙炔总阀,压力回零后再关分压阀,此时需按红色点火开关使管路中的燃气烧尽,压力才能回零;

3)关掉空压机:先放水,再依次关掉工作开关、风机开关以及机器后面的防水开关;

4)退出工作站,依次关掉灯电源、主机电源以及电脑。

实验数据记录和处理(含标准曲线图—Cu的吸光度与浓度标准曲线)

样品YZD01-3即Samp4溶液中Cu的含量=[(分析浓度×0.1/1000)/称样重量]×100%=[(0.1569mg/L×0.1/1000)/(0.1994g×1000)]×100%=7.87×10-6%

样品YZD01-3即Samp4溶液中Cu的含量=[(分析浓度×0.1/1000)/称样重量]×100%=[(0.1569mg/L×0.1/1000)/(0.1994g×1000)]×100%=7.87×10-6%

样品YZD01-4即Samp5溶液中Cu的含量=[(分析浓度×0.1/1000)/称样重量]×100%=[(0.1685mg/L×0.1/1000)/(0.2017g×1000)]×100%=8.35×10-6%

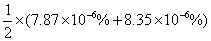

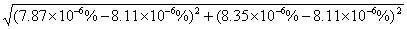

两种样品的平均值ω= =8.11×10-6%,标准偏差σ=

=8.11×10-6%,标准偏差σ= =0.339×10-8

=0.339×10-8

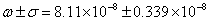

因此最终数据应为

结果与讨论:

实验结果:

本实验通过酸溶法溶解硅酸盐岩石样品,将其定容于100ml的容量瓶中制成待测溶液;然后通过配置标准溶液绘制出浓度—吸光度标准曲线,最后通过标准曲线得出待测溶液的浓度,进而计算出待测样品溶液中Cu的含量。最终测得样品YZD01-3即Samp4溶液中Cu的含量为7.87×10-6%;样品YZD01-4即Samp5溶液中Cu的含量为8.35×10-6%。

实验注意事项:

1. 本次试验的样品预处理阶段可以采用四种处理方法:湿法消解、干法消解、微波消解以及炉内消解。

其中湿法消解是经典的样品前处理方法,其要求在消解过程中尽量少带入试剂空白和少造成样品损失,对于易消解的样品快速方便。但缺点是易造成污染(如试剂、器皿等)。

干法消解的优点是几乎没有试剂污染,但缺点是时间长,不适合易挥发性元素。

微波消解的优点是酸用量少,引入空白少,易挥发元素没有损失。缺点是石墨炉分析必须赶酸。

炉内消解的优点是不会引入污染,但缺点是基体干扰大,样品均匀性问题。

因此综上考虑本次试验采用的是湿法消解。

2. 在溶解样品的过程中一定要保证样品全部溶解成溶液,没有固体残渣的剩余,且溶液中的酸均被赶出。

3. 上AAS机测试之前一定要设置好与本实验相符合的所有数据,将仪器调试完好。在打开助燃气和燃气的开关时一定要注意顺序,防止爆炸。

4. 测试样品的过程中要把燃烧器的门关上,避免风影响测试结果。

5. 每测试样品之前,都要通入一段时间的蒸馏水清洗。

6. 在整个试验过程中,相关步骤的实验完成之后一定要记得清洗仪器,最终实验完成后要记得关闭仪器的正确顺序。

7. 标准曲线法适用于共存组分间互不干扰的试样,采用标准曲线法应注意所配置的标准溶液的浓度应使吸光度同浓度之间保持在直线关系内;空白溶液应预先喷雾测定其吸光度,从试样的吸光度中扣除空白或将空白溶液用于仪器调零,以扣除本底空白;整个分析过程中操作条件应保持不变;原子吸收标准曲线的斜率经常可能有微小变化。

实验误差:

1. 称取样品时所造成的误差,如称样时有微量的样品洒落或者称样纸未进行更换。

2. 在将溶液转移至100ml的容量瓶中时有少许的溅落。

3.在定容时由于视角问题或是未等溶液冷却便定容导致溶液的浓度不准确。

4.在将溶液转移至容量瓶的过程中原仪器没有清洗,导致样品损失。

5. 在AAS上机测试时,一些参数未能设置精确。

6.在AAS上机测试时没有把燃烧器的门关上,收到风等因素的影响。

7.测试样品之前毛细管忘记通入蒸馏水中清洗。

第二篇:AAS

Australian Accounting StandardAAS 10

December 1999

Recoverable Amount ofNon-Current AssetsPrepared by thePublic Sector Accounting Standards Board of theAustralian Accounting Research Foundation and by theAustralian Accounting Standards Board

Issued by theAustralian Accounting Research Foundationon behalf of the Australian Society of CertifiedPractising Accountants and The Institute ofChartered Accountants in Australia

Obtaining a Copy of this Accounting StandardCopies of this Standard are available for purchase from the AustralianAccounting Research Foundation by contacting:

The Customer Service OfficerAustralian Accounting Research Foundation211 Hawthorn RoadCaulfield Victoria 3162AUSTRALIA

Phone:Fax:E-mail:Web site:(03) 9524 3637(03) 9524 3687publications@aarf.asn.auwww.aarf.asn.au

Other enquiries:

Phone:Fax:E-mail:(03) 9524 3600(03) 9523 5499standard@aarf.asn.au

COPYRIGHT

? 1999 Australian Accounting Research Foundation (AARF). The text,graphics and layout of this Accounting Standard are protected by Australiancopyright law and the comparable law of other countries. No part of theAccounting Standard may be reproduced, stored or transmitted in any form orby any means without the prior written permission of the AARF except aspermitted by law.

ISSN 1034-3717

AAS 102

CONTENTS

MAIN FEATURES OF THE STANDARD …page 5 Section and page number 1Application …7

2Scope …7 Not-for-Profit Entities …7 Non-Current Assets Measured at Fair Value, Net Market Value or Net Fair Value …8Inventories … 9Materiality … 9

3

4

5Operative Date …9 Purpose of Standard …10 Recoverable Amount Test …10General …10 Recoverable Amount and Groupsof Assets …11Community Service Obligations … 116

7

8

9Class of Non-Current Assets …18Not-for-Profit Entities …18

CONFORMITY WITH INTERNATIONAL AND NEWZEALAND ACCOUNTING STANDARDS …page 20BACKGROUND TO REVISION … page 21Accounting for Recoverable AmountWrite-Downs …12Disclosures …12Transitional Provisions …13Definitions …14

AAS 103CONTENTS

Defined words appear in italics the first time they appear in asection. The definitions are in Section 9. Standards are printed inbold type and commentary in light type.

AAS 104CONTENTS

MAIN FEATURES OF THE STANDARD

The Standard is principally a reissue of the requirements concerning therecoverable amount test for non-current assets set out in AustralianAccounting Standard AAS 10 “Accounting for the Revaluation ofNon-Current Assets” as issued in June 1996. In addition, it includes newcommentary clarifying that, where net cash flows are discounted to theirpresent value when measuring the recoverable amount of non-current assets,meeting the requirement (retained from the superseded Standard) to disclosethe assumptions made in respect of the assets’ recoverable amount includesdisclosing the discount rate used.

The Standard, which applies to non-current assets measured on the cost basis:(a)requires the carrying amounts of non-current assets to be writtendown to their recoverable amount when their carrying amount isgreater than their recoverable amount

defines the recoverable amount of an asset as the net amount that isexpected to be recovered through the cash inflows and outflowsarising from its continued use and subsequent disposal

excludes not-for-profit entities from the requirement to write downto their recoverable amount assets which are not held for theprimary purpose of generating net cash inflows

defines a not-for-profit entity to mean an entity whose financialobjectives do not include the generation of profit

requires disclosure of the carrying amounts of non-current assetswritten down to their recoverable amount, the amounts ofrecoverable amount write-downs, and accounting policies applied inrespect of the method of determining recoverable amount.(b)(c)(d)(e)

Measuring non-current assets on the cost basis includes measuringnon-current assets at “deemed cost”. A class of non-current assets ismeasured at deemed cost where the entity previously revalued that class ofassets and, under the transitional provisions in Australian AccountingStandard AAS 38 “Revaluation of Non-Current Assets”, as issued inDecember 1999, elects to deem the opening (revalued) carrying amount ofassets comprising the class to be the assets’ cost for the purpose of revertingto the cost basis as at the date of first applying AAS 38.

Because the Standard applies to non-current assets measured on the costbasis, it requires recoverable amount write-downs to be recognised asexpenses in net profit or loss/result. Background to this requirement is

AAS 105FEATURES

provided in the “Background to Revision” set out after the AccountingStandard.

The Australian Accounting Standards Board and the Public SectorAccounting Standards Board have developed Exposure Draft ED 99“Impairment of Assets”, which was issued for comment in December 1999.A Standard developed from ED 99 would replace the Standard. ED 99itemises a range of proposed scope exclusions. Similar scope exclusions arenot itemised in the Standard, which retains the style of drafting from thesuperseded Standard. However, as no substantive changes have been madeto the requirements of the Standard, the scope of the Standard is essentiallyunchanged from the superseded Standard.The Standard has been reissued at this time solely to facilitate the separateissue of Australian Accounting Standard AAS 38 “Revaluation ofNon-Current Assets”. Whilst the Standard has been reissued for this purpose,the Boards do not support the option carried forward to the Standard to useundiscounted cash flows to measure an asset’s recoverable amount.

AAS 106FEATURES

AUSTRALIAN ACCOUNTING STANDARDAAS 10 “RECOVERABLE AMOUNT OF NON-CURRENT ASSETS”

1

1.1ApplicationThis Standard applies to:

(a)general purpose financial reports of each reporting entityto which Accounting Standards operative under theCorporations Law do not apply; or

financial reports that are held out to be general purposefinancial reports by an entity which is not a reportingentity, and to which Accounting Standards operativeunder the Corporations Law do not apply.(b)

1.1.1Accounting Standards operative under the Corporations Law applyto companies and to other entities required by legislation, ministerialdirective or other government authority to apply such Standards.Reporting entities which are not required to apply AccountingStandards operative under the Corporations Law are required toapply this Standard.

2

2.1ScopeNot-for-Profit EntitiesThis Standard does not apply to non-current assets ofnot-for-profit entities where the future economic benefitscomprising those assets are not primarily dependent on theassets’ ability to generate net cash inflows.

The requirement that the carrying amounts of non-current assets donot exceed their recoverable amount does not apply to thenon-current assets of not-for-profit entities whose future economicbenefits are not primarily dependent on the ability to generate netcash inflows. A diminution in the ability of the non-current assetsof not-for-profit entities to generate net cash inflows does notnecessarily represent a decline in their future economic benefits.The future economic benefits comprising such assets are indicatedby the goods and services the assets provide.

7?1.12.1.1AAS 10

2.1.2The non-current assets of a government department which providessubsidised public transport are an example of non-current assetswhich are exempt from the requirement to apply the recoverableamount test. Although government departments providingsubsidised public transport receive cash inflows from consumers,their continued operation is dependent on government subsidy and,accordingly, they generally do not have a profit objective.

The form of the future economic benefits comprising somenon-current assets of not-for-profit entities is in the services theassets provide rather than in the generation of net cash inflows fromconsumers. The carrying amount of such assets in the statement offinancial position should reflect their remaining future economicbenefits as at the reporting date, measured at an amount consistentwith the measurement model applied by the entity in respect of itsnon-current assets. In those circumstances where the futureeconomic benefits comprising non-current assets of not-for-profitentities are primarily dependent on the assets’ ability to generate netcash inflows, this Standard specifies that the carrying amount ofsuch assets should not exceed their recoverable amount.2.1.3

Non-Current Assets Measured at Fair Value, NetMarket Value or Net Fair Value

2.2This Standard does not apply to non-current assets measured atfair value, net market value or net fair value as required orpermitted by another Australian Accounting Standard.

This Standard does not apply to non-current assets measured on thefair value basis as permitted by Australian Accounting StandardAAS 38 “Revaluation of Non-Current Assets”. AAS 38 requiresthat where a class of non-current assets is measured on the fairvalue basis, revaluations are to be made with sufficient regularity toensure that the carrying amounts of the assets comprising that classdo not differ materially from their fair value. The carrying amountsof non-current assets measured on the fair value basis under AAS 38cannot be overstated, and accordingly, these assets are exemptedfrom the application of this Standard.

Other assets referred to in paragraph 2.2 include:

(a)financial assets of public sector borrowing/financingentities measured at net market value as at the reportingdate with changes in net market value recognised asrevenues or expenses in net profit or loss/result for thereporting period, as permitted by AAS 38

8?2.1.22.2.12.2.2AAS 10

(b)assets measured at net market value as required by:

(i)

(ii)Australian Accounting Standard AAS 25“Financial Reporting by Superannuation Plans”Australian Accounting Standard AAS 26“Financial Reporting of General InsuranceActivities”

Australian Accounting Standard AAS 35“Self-Generating and Regenerating Assets”.(iii)

Inventories

2.3

2.3.1This Standard does not apply to inventories.Inventories are accounted for in accordance with AustralianAccounting Standard AAS 2 “Inventories”, which prohibits thecarrying of inventories at amounts greater than net realisable value.

Materiality

2.3.2The standards specified in this Standard apply to the financial reportwhere information resulting from their application is material, inaccordance with Australian Accounting Standard AAS 5“Materiality”.

3

3.1

3.2Operative DateThis Standard applies to reporting periods beginning on or after1 July 2000.This Standard may be applied to reporting periods beginningbefore 1 July 2000, provided that Australian AccountingStandard AAS 38 “Revaluation of Non-Current Assets”, asissued in December 1999, is also applied for the same reportingperiods.

This revised Standard and Australian Accounting Standard AAS 38“Revaluation of Non-Current Assets” (as issued in December 1999)together replace Australian Accounting Standard AAS 10“Accounting for the Revaluation of Non-Current Assets”, as issuedin June 1996. AAS 10, as issued in June 1996, continues to applyfor reporting periods that begin before 1 July 2000. However, anentity can elect to apply this Standard early in accordance with

9?2.2.23.2.1AAS 10

paragraph 3.2. If it makes this election, the entity would not also beobliged to comply with AAS 10, as issued in June 1996, for thereporting periods to which the election applies, provided the entityalso complies with Australian Accounting Standard AAS 38“Revaluation of Non-Current Assets”. The scope of AAS 38 islimited to applying the cost basis or the fair value basis to measurethe carrying amounts of non-current assets.

3.3When operative, this Standard and Australian AccountingStandard AAS 38 “Revaluation of Non-Current Assets”, asissued in December 1999, supersede Australian AccountingStandard AAS 10 “Accounting for the Revaluation ofNon-Current Assets” as issued in June 1996.

4

4.1Purpose of StandardThe purpose of this Standard is to:

(a)

(b)require the application of the recoverable amount test tonon-current assetsrequire disclosures relating to the application of therecoverable amount test to non-current assets.

5

5.1Recoverable Amount TestGeneralSubject to paragraph 5.2, a non-current asset must be writtendown to its recoverable amount when its carrying amount isgreater than its recoverable amount.

A recoverable amount write-down recognises that future economicbenefits which had previously been assessed as being available tothe entity no longer exist.

Recoverable amount write-downs are not revaluations.Accordingly, the recognition of a recoverable amount write-down inrespect of a non-current asset does not oblige the entity to revaluethe class of non-current assets to which that asset belongs.5.1.15.1.2

AAS 1010?3.2.1

Recoverable Amount and Groups of Assets

5.2Where a group of assets working together supports thegeneration of net cash inflows relevant to the determination ofrecoverable amount, the net cash inflows must be estimated forthe relevant group of assets and the recoverable amount testmust be applied to the carrying amount of that group of assets.

It is not appropriate to identify the expected net cash inflowsapplicable to individual assets where a group of assets workingtogether supports the generation of net cash inflows relevant to thedetermination of recoverable amount. In order to identify whetherthere has been a decline in the future economic benefits comprisingthose individual assets, it is necessary to estimate the net cashinflows for the relevant group of assets and compare that amountwith the carrying amount of the group of assets.5.2.1

Community Service Obligations

5.3Where, pursuant to legislation, ministerial directive or othergovernment authority, non-current assets are used to providegoods or services at no charge, or at less than full cost recovery,those assets must be included in the group of assets that isdependent on the provision of those goods or services to enableit to generate net cash inflows. The net cash inflows must beestimated for that group of assets and the recoverable amounttest must be applied to the carrying amount of that group ofassets.

Entities other than not-for-profit entities, for example governmentbusiness entities, may, pursuant to legislation, ministerial directiveor other government authority, be required to provide certain goodsor services without charge or at a charge which is less than the fullcost of those goods and services. As a consequence of meeting such“community service obligations”, an entity may receive governmentsupport in the form of grants and capital or other contributions.The carrying amounts of non-current assets deployed in communityservice activities are not written down solely because the amountspresently expected to be recovered directly from the goods andservices produced by those activities are less than the carryingamount of those assets. In these cases, the relevant group of assetswould not be restricted to those assets directly employed insatisfying the community service obligations imposed by legislation,ministerial directive or other government authority.5.3.15.3.2

AAS 1011?5.2

6

6.1Accounting for Recoverable AmountWrite-DownsWhere the carrying amount of a non-current asset or a group ofnon-current assets is written down to its recoverable amount inaccordance with paragraph 5.1 or paragraph 5.2, the decrementin that carrying amount must be recognised as an expense in netprofit or loss/result for the reporting period in which therecoverable amount write-down occurs.

After the expiry of the transitional provisions in AustralianAccounting Standard AAS 38 “Revaluation of Non-Current Assets”,this Standard will apply only to non-current assets measured on thecost basis. It is consistent with the cost basis of measurement totreat any recoverable amount write-down of a non-current asset asan expense in net profit or loss/result.

Upon the initial adoption of AAS 38, if an entity elects to revert tothe cost basis to measure a previously revalued class of non-currentassets, either of the following will occur:

(a)retrospective adjustments will be made to adjust thecarrying amounts of the assets to the amounts at which theywould have been carried under the cost basis. In this case,the balance of the asset revaluation reserve in respect ofthat class will be reversed in accordance with thetransitional provisions in AAS 38

the revalued carrying amounts of the assets within thatclass as at the date of first adopting that Standard will bedeemed to be the cost of those assets, and the balance of theasset revaluation reserve as at that date will be unaffectedby the change.6.1.16.1.2(b)

7

7.1DisclosuresWhere the carrying amount of a non-current asset or a class ofnon-current assets has been written down to its recoverableamount in accordance with paragraph 5.1 or paragraph 5.2, thefinancial report must, in respect of each such non-current assetor class of non-current assets, disclose:

(a)its carrying amount

12?6.1AAS 10

(b)

(c)

7.2the recoverable amount write-down recognised duringthe reporting periodthe assumptions made in respect of its recoverableamount.Where some or all of the assets within a class of non-currentassets have been written down to their recoverable amountduring the reporting period or a previous reporting period, thefinancial report must disclose the aggregate carrying amount ofeach of the following:

(a)assets within that class of non-current assets which arecarried at that recoverable amount less, whereapplicable, any subsequent accumulated depreciation

any other assets within that class of non-current assets.(b)

7.2.1The term “depreciation”, which is often used interchangeably withthe term “amortisation”, includes amortisation for the purposes ofthis Standard. The terms have the same meaning, however,depreciation is generally used in relation to non-current assets thathave physical substance while amortisation is generally used inrelation to intangible non-current assets.

The financial report must, regardless of whether non-currentassets have been written down to recoverable amount during thereporting period, disclose whether, in complying withparagraphs 5.1 and 5.2, the expected net cash flows included indetermining the recoverable amounts of non-current assets havebeen discounted to their present value.

Where net cash flows are discounted to their present value whenmeasuring the recoverable amount of non-current assets, disclosureof the assumptions made in respect of the assets’ recoverableamount [to comply with paragraph 7.1(c)] includes disclosure of thediscount rate used.7.37.3.1

8

8.1Transitional ProvisionsWhere the superseded Standard did not apply to the entity andaccounting policies required by this Standard are not alreadybeing applied as at the beginning of the reporting period towhich this Standard is first applied, they must be applied as atAAS 1013?7.1

that date. Where this gives rise to initial adjustments whichwould otherwise be recognised in net profit or loss/result, the netamount of those adjustments, including any adjustments todeferred income tax balances, must be adjusted against retainedprofits (surplus) or accumulated losses (deficiency) as at thebeginning of the reporting period to which this Standard is firstapplied.

9

9.1DefinitionsIn this Standard:

accounting policies means the specific accounting principles,bases or rules adopted in preparing and presenting thefinancial report

assets means future economic benefits controlled by the entity asa result of past transactions or other past events

carrying amount means:

(a)in relation to an asset, the amount at which theasset is recorded in the accounting records as at aparticular date. In application to a depreciableasset, carrying amount means the net amount afterdeducting accumulated depreciation

in relation to a class of assets, the sum of thecarrying amounts of the assets in that class(b)

cash assets means cash on hand and cash-equivalent assetscash-equivalent assets means highly liquid investments withshort periods to maturity which are readily convertible tocash on hand at the investor’s option and are subject to aninsignificant risk of changes in value

cash on hand means notes and coins held, and deposits held atcall with a financial institution

class of non-current assets means a category of non-currentassets having a similar nature or function in the operationsof the entity, which category, for the purpose of disclosurein the financial report, is shown as a single item withoutsupplementary dissection

AAS 1014?8.1

current asset means an asset that:

(a)is expected to be realised in, or is held for sale orconsumption in, the normal course of the entity’soperating cycle; or

is held primarily for trading purposes or for theshort-term and is expected to be realised withintwelve months of the reporting date; or

is cash or a cash equivalent asset which is notrestricted in its use beyond twelve months or thelength of the operating cycle, whichever is greater(b)(c)

economic entity means a group of entities comprising the parententity and each of its subsidiaries

entity means any legal, administrative, or fiduciaryarrangement, organisational structure or other party(including a person) having the capacity to deploy scarceresources in order to achieve objectives

expenses means consumptions or losses of future economicbenefits in the form of reductions in assets or increases inliabilities of the entity, other than those relating todistributions to owners, that result in a decrease in equityduring the reporting period

extraordinary items means items of revenue and expense that areattributable to transactions or other events of a type thatare outside the ordinary activities of the entity and are not ofa recurring nature

fair value means the amount for which an asset could beexchanged, or a liability settled, between knowledgeable,willing parties in an arm’s length transaction

financial asset means any asset that is:

(a)

(b)

(c)cash; ora contractual right to receive cash or anotherfinancial asset from another entity; ora contractual right to exchange financialinstruments with another entity under conditionsthat are potentially favourable; or

15?9.1AAS 10

(d)an equity instrument of another entity

financial institution means:

(a)an entity (including an economic entity) whoseprincipal activity is to take deposits or borrow, orboth take deposits and borrow, with the objective oflending or investing in financial assets other thanequity instruments, but excluding:

(i)entities which take deposits or borrowprincipally from other entities in theeconomic entity; and

general insurers, life insurers andsuperannuation plans; or(ii)

(b)an entity (including an economic entity) subject tothe Banking Act 1959 or any replacement legislationgeneral purpose financial report means a financial reportintended to meet the information needs common to userswho are unable to command the preparation of reportstailored so as to satisfy, specifically, all of their informationneeds

inventories means assets:

(a)

(b)

(c)held for sale in the ordinary course of business; orin the process of production, preparation orconversion for such sale; orin the form of materials or supplies to be consumedin the production of goods or services available forsale

excluding depreciable assets, as defined in AustralianAccounting Standard AAS 4 “Depreciation”

monetary assets means money held, and assets to be received infixed or determinable amounts of money

net market value means the amount which could be expected tobe received from the disposal of an asset in an active andliquid market after deducting costs expected to be incurredin realising the proceeds of such a disposal

AAS 1016?9.1

net profit or loss/result means:

(a)in the case of an entity that is not an economicentity, profit or loss/result after income tax expense(income tax revenue) from ordinary activities andextraordinary items

in the case of an entity that is an economic entity,profit or loss/result after income tax expense(income tax revenue) from ordinary activities andextraordinary items, before adjustment for thatportion that can be attributed to outside equityinterest(b)

non-current assets means all assets other than current assetsnot-for-profit entity means an entity whose financial objectivesdo not include the generation of profit

ordinary activities means activities that are undertaken by anentity as part of its business or to meet its objectives andrelated activities in which the entity engages in furtheranceof, incidental to, or arising from activities undertaken tomeet its objectives

parent entity means an entity which controls another entity

property, plant and equipment means tangible non-current assetsthat:

(a)are held by an entity for use in the production orsupply of goods or services, for rental to others, orfor administrative purposes and may include itemsheld for maintenance or repair of such assets

have been acquired or constructed with theintention of being used on a continuing basis(b)

recognised means reported on, or incorporated in amountsreported on, the face of the statement of financialperformance or the statement of financial position (whetheror not further disclosure of the item is made in notes)recoverable amount means, in relation to an asset, the netamount that is expected to be recovered through the cashinflows and outflows arising from its continued use andsubsequent disposal

AAS 1017?9.1

reporting date means the end of the reporting period to whichthe financial report relates

reporting entity means an entity (including an economic entity)in respect of which it is reasonable to expect the existence ofusers dependent on general purpose financial reports forinformation which will be useful to them for making andevaluating decisions about the allocation of scarce resourcesstatement of financial performance means profit and loss orother operating statement as referred to in other AustralianAccounting Standards

subsidiary means an entity which is controlled by a parententity.

Class of Non-Current Assets

9.1.1Underpinning the requirements in paragraphs 7.1 and 7.2 is thedefinition of “class of non-current assets” in paragraph 9.1. Thisdefinition, which is consistent with the view that non-current assetsshould be classified according to their nature or function in theoperations of the entity, defines classes of non-current assets interms of the lowest level of aggregation adopted in the financialreport for disclosure of non-current assets having a similar nature orfunction. In the preparation of consolidated financial reports, thedefinition of “class of non-current assets” is applied to the economicentity as a single entity.

Not-for-Profit Entities

9.1.2Not-for-profit entities include all public sector entities other thangovernment business entities, and those private sector entities whoseobjectives do not include the generation of profit, including asurplus, for distribution to members.

Government business entities are those government entities whoseobjectives encompass the generation of profit from the provision ofgoods and services to consumers at charges equal to or greater thanthe full cost of those goods and services. The financial objectives ofgovernment business entities may encompass the achievement ofeither a nominated profit target or a nominated rate of return onassets employed.

Private sector not-for-profit entities are frequently characterised bythe absence of defined ownership interests that can be sold,

18?9.19.1.39.1.4AAS 10

transferred and/or redeemed, and are frequently formed for social,educational, religious, health or philanthropic purposes. Privatesector entities which would be classified as not-for-profit entitieswould include charitable organisations and those clubs and societieswhose overall financial objectives do not encompass the generationof profit. Private sector not-for-profit entities do not include clubs,credit unions, co-operatives, member service organisations and otherorganisations which generate profit for the benefit of members. Anentity which ostensibly operates on a not-for-profit basis but whichis part of an economic entity whose objective is to generate profitwould in substance be an entity concerned with profit seeking and,accordingly, would not meet the definition of a not-for-profit entity.

9.1.5Not-for-profit entities may sell particular goods and services toconsumers at charges greater than the full cost of those goods andservices, and may fund future acquisitions of plant and equipmentfrom surpluses generated by such sales. However, the continuinglong-term operation of not-for-profit entities largely depends ongrants, parliamentary appropriations, membership subscriptionsand/or gifts, donations and bequests, rather than on the sale of goodsand services at a profit.

AAS 1019?9.1.4

CONFORMITY WITH INTERNATIONAL ANDNEW ZEALANDACCOUNTING STANDARDSConformity with International AccountingStandards

The International Accounting Standards Committee issued InternationalAccounting Standard IAS 36 “Impairment of Assets” (which specifies arecoverable amount test) in June 1998. It applies to a broader range of assetsthan non-current assets, and its requirements are considerably more detailedthan those set out in this Standard.

The Australian Accounting Standards Board and the Public SectorAccounting Standards Board have developed Exposure Draft ED 99“Impairment of Assets” (issued for comment in December 1999), taking intoaccount the requirements of IAS 36. The Standard developed from ED 99would replace this Standard. The Boards have proposed in ED 99 that usingundiscounted cash flows to measure recoverable amount should beprohibited, consistent with IAS 36.

Conformity with New Zealand AccountingStandards

No accounting standard dealing specifically with the application of therecoverable amount test to non-current assets, or corresponding to IAS 36“Impairment of Assets”, has been issued in New Zealand.

AAS 1020CONFORMITY

BACKGROUND TO REVISION

This section does not form part of the Standard. It is a summary of thereasons for the current revision of the Standard.

1The Standard includes the requirements concerning the recoverableamount test for non-current assets set out in Australian AccountingStandard AAS 10 “Accounting for the Revaluation of Non-CurrentAssets” as issued in June 1996. It coincides with, and is issuedsolely to facilitate the issue of, Australian Accounting StandardAAS 38 “Revaluation of Non-Current Assets” based on theproposals in Exposure Draft ED 92 “Revaluation of Non-CurrentAssets”.

The Australian Accounting Standards Board and the Public SectorAccounting Standards Board have included the recoverable amounttest in a separate Standard from AAS 38:

(a)

(b)because the recoverable amount test is applicable tonon-current assets measured on the cost basis; andto avoid the need to reissue AAS 38 when the requirementsfor the recoverable amount test are amended as a result ofthe Boards’ IASC harmonisation project on Impairment ofAssets.2

Principal Changes from the Previous Standard

3The Standard uses the term “recoverable amount write-down” ratherthan “revaluation decrement” to describe the entry to write down anon-current asset’s carrying amount to its recoverable amount,because AAS 38 defines “revaluation” as “the act of recognising areassessment of the carrying amount of a non-current asset to its fairvalue as at a particular date, but excludes recoverable amountwrite-downs”. This amended definition of “revaluation” reflects therequirement in AAS 38 that when non-current assets are revalued,they are revalued to their fair values.

The scope of the revised AAS 10 is restricted to non-current assetsmeasured on the cost basis (which includes the “deemed cost” basisas described in the Main Features of the Standard). AAS 38 permitsclasses of non-current assets to be measured on the cost basis or thefair value basis, and non-current assets carried at fair value cannotbe overstated. Because the scope of the revised AAS 10 is restrictedto non-current assets measured on the cost basis, the Standardrequires recoverable amount write-downs to be recognised as

21BACKGROUND4AAS 10

expenses in net profit or loss/result. The previous Standard (whichapplied to non-current assets measured on the cost basis or arevaluation basis) required recoverable amount write-downs to bedebited to the balance of the asset revaluation reserve in respect ofthe same class of non-current assets, to the extent of any existingcredit balance in the reserve in respect of that class, with anyremainder recognised as an expense in net profit or loss/result.5The Standard includes new commentary clarifying that, where netcash flows are discounted to their present value when measuring therecoverable amount of non-current assets, meeting the requirement(retained from the superseded Standard) to disclose the assumptionsmade in respect of the assets’ recoverable amount includesdisclosing the discount rate used.

AAS 1022BACKGROUND